Life Insurance With Long Term Care Benefits

Asset-based insurance, an alternative to traditional long term care insurance.

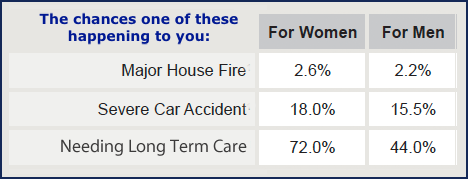

There a millions of Americans entering into Medicare-age every year.

Many think that health insurance or Medicare pays for long term care, it doesn't.

- longtermcare.gov

What are your options?

Your options depend on your health, age, and financial goals.

If you want to insure for the risk then you must be healthy enough to

qualify for insurance and be able to afford it.

If you are not going to insure and you plan to pay for care

out of pocket then you will need $30,000-$100,000+ or more per person

per year to cover the cost of care. The cost of care depends on the type

of care needed and where the care is provided.

Predicting your future.

Your future will happen whether you plan for it or not. By waiting

to decide, you are deciding to wait. If your health changes you may not

be insurable.

Of those applying for long term care insurance ages 60-69 25% are declined coverage because of health, ages 70-79 we find 44% are declined. The younger you are when you buy insurance the cheaper it is and more likely you will health-qualify.

According to the Alzheimer's Association 1 in 3 will die

from Alzheimer's or another form of dementia. Alzheimer's is expected to

become the leading cause of death in the future. Do you really

think you are going to beat the odds?

If you think that you will not need long term care when you

are old and frail then consider that you will still be leaving a legacy

with the life insurance. Life insurance benefits the living.

These Life/LTC policies are designed specifically to be used for long term care.

You don't buy insurance planning to use it tomorrow.

Protecting your future.

What do you want to have happen with your estate? Most reply they

want it to go to their children, grandchildren, or a charity.

Jonathan Pond, award winning financial advisor claims that 90% of estates go in this order:

1. Nursing home

2. IRS

3. Children

4. Grandchildren

5. Charity

"The more expensive the premium, the more important it is that you have it."

- Ric Edelmen, America's #1 Financial Advisor (Barron's)

Is Life insurance with LTC better than traditional LTC insurance?

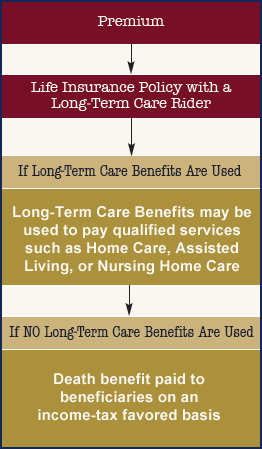

Life insurance with long term care benefits also called

asset-based insurance or linked-benefit insurance provides protection

for the premium dollars you pay that traditional long term care

insurance does not provide. Plus with Life/LTC your premiums will never

increase.

With a Life/LTC policy the premiums you pay will go towards a policy that you can use for long term care and if you do not need care, or only need some care, the policy will pay a tax-free death benefit to your beneficiaries. If you have traditional LTC insurance you will lose the premiums paid if you don't use the policy.

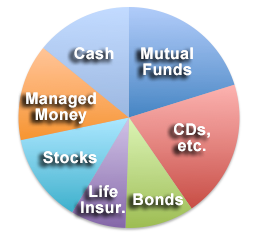

If long term care services are needed, which assets would you use first?

Typically you would use cash reserves for long term care expenses

because cash are usually the lowest yielding and most accessible.

Instead of earmarking an entire account (or more) for long term care

expenses you can reallocate a portion of the cash reserves to purchase a

life insurance policy with long term care benefits.

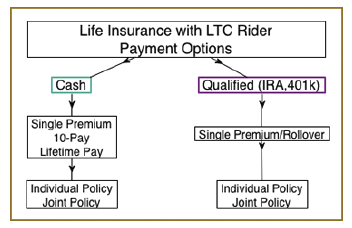

How you can pay for your Life/LTC policy.

You can reposition existing money such as CDs, Money

Market, Savings, or you can 1035 exchange an existing universal/whole

life insurance policy. See the Pension Protection Act for more information.

Q: Can I use my IRA money or one of my old 401k's to fund the plan?

A: If you are over 59 1/2 and if available in your state,

you can do a 1035 exchange or "trustee to trustee transfer" to

reposition the money to fund the policy from a 401k/IRA account. Spouses can share benefits,

Q: I am facing a RMD next year when I turn 70 1/2, will I be able to use the RMD to pay for my policy?

A: Your RMD (Required Minimum Distribution) will automatically

be taken out of your qualified account to pay for the premium. Depending

on how much your RMD will be would determine if you needed an

additional distribution. RMD Calculator

Long Term Care is a family affair.

The majority of caregivers are family members.