To Self-Insure or Not

Is self-insuring a wise investment?

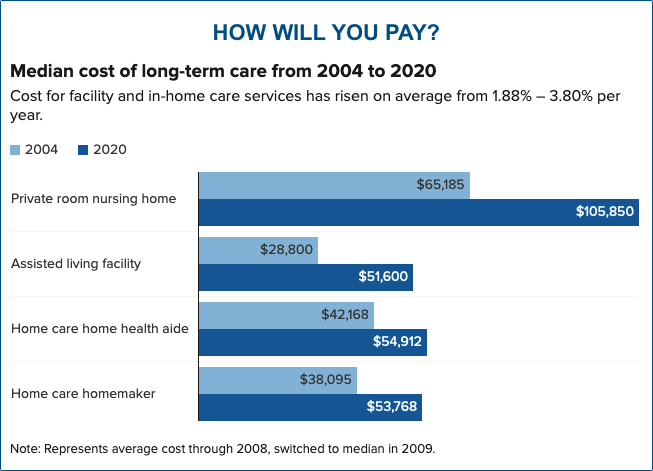

Some may believe they can afford to self-insure. But even those with significant assets could erode their savings very quickly should they need long term care.

The first concern should be whether or not you will be insurable in the future if you should decide later to buy insurance. Insurability is determined by: application information, phone interview, and medical records review. Not every applicant qualifies.

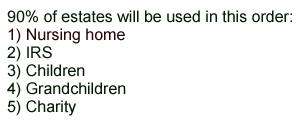

If you have decided to self-insure it is recommended that you work with an estate and elder law attorney to make sure your assets are protected. More people are worried that the IRS will take a big chunk out of their estate than what they might pay for long term care.

Using Your Investments/Savings To Pay For

Care

How much principal would you need to generate

$6,000-$9,000 a month for care?

For every $1,000 of monthly retirement income you want

to generate from your own savings, you will need about

$230,000 in assets, according to the Schwab

Center for Investment Research. For example, if

you want $3,000 a month, or $36,000 a year, you would

need savings of $690,000. That's a conservative

estimate, assuming that you earn 5.2% on your

investments and live off the earnings without dipping

into the principal.

For a $6,000/month care cost you would need

$1,380,000.

For a couple you would need $2,760,000

Got a pencil and calculator?

The average nursing home stay is 2.5 years (excludes

home, assisted living, memory care).

The average nursing home cost Nationwide

in 2019:

- Semi-Private Room $8,000/month x 12 = $96,000/year

- Private Room $7,000/month x 12 = $82,000/year

The cost of nursing home care varies by location. In New York City the cost is $12,000/month $144,000/year and Athens GA is $6,300/month $75,600/year. To find the average cost for your area you can call local care providers (https://www.NewLifeStyles.com).

Key reasons to consider long-term care insurance, advice from Schwab Investments

- Long-term care insurance can provide security for years to come by helping to:

- Secure quality, affordable care

- Preserve independence and financial freedom

- Help provide for the rising cost of long-term care

- Relieve family members and friends from having to provide care

- Safeguard your assets for your spouse and other heirs

- Help pay for expenses not covered by Medicare and Medigap

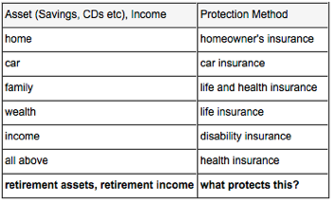

Do You Know If Are You Protecting Your Retirement?

Most long term care funds come from life savings or retirement savings.

Can you think of anything other than the cost of long term care that could deplete your lifetime savings, retirement income, or portfolio?

If you needed long term care tomorrow, what would be the consequences to those around you?

In that situation it is the consequences that matter, not the money. Once someone needs care money no longer becomes an issue. Once someone needs care no amount of money can buy insurance. Their decision to self-insure will prove to be right or wrong.

|

||||||||||||||||||||

Some People Just Dislike Use-It-Or-Lose It Insurance

For those who worry that they may die before they use

their long term care insurance there are alternatives

to use-it-or-lose-it long term care insurance. The

only insurance that is guaranteed to pay is life

insurance because it's the only event that is

guaranteed to happen.

There are two other choices to pay for care:

Annuity/LTC or Life insurance/LTC

The life insurance with a LTC rider is great for

those who have an old cash-value whole or universal

life policy, you use the 1035 tax-free exchange to

transfer the cash value to a life insurance policy

that has LTC benefits. You will not have to pay

capital gains - Pension

Protection Act. If you are over 59 1/2 years old

in most states you can use qualified money (IRA/401k)

to fund your life insurance with LTC. This might

appeal those who have large retirement accounts and do

not need the income. The policy will cover the RMD.

See LifeLTC

The annuity/LTC is a safe way to put away money for

care, if not used for care the annuity passes to your

estate. These are fixed deferred annuities. The

annuity/LTC requires less underwriting than

traditional LTC insurance or the life/LTC products.

See Annuity/LTC

The life insurance and annuity with long term care benefits do not qualify for the state Partnership asset protection program, only traditional long term care insurance qualifies. See Partnership

Long Term Care is a family affair.

The majority of caregivers are family members.